At Colorado Orthodontics in Denver, we are dedicated to offering the latest advancements in orthodontic technology to our patients. We understand that orthodontic treatment is a significant decision, and we are committed to providing cutting-edge solutions that not only enhance your smile but also ensure a comfortable and convenient experience. Traditional Metal Braces - Time-Honored […]

Learn MoreThe holiday season is upon us, and what better way to celebrate than by giving yourself the gift of a confident, radiant smile? At Colorado Orthodontics, we understand that your smile is your most valuable asset, and we're here to make your holiday season extra special. 🎄 A Smile That Shines as Bright as the […]

Learn More Welcome to Colorado Ortho in Denver, CO, where every smile gets the personalized care it deserves. As we step into National Orthodontic Health Awareness Month, we invite you to join us in celebrating the beauty and health of your smile. This October, let's explore the importance of orthodontic health and how it can transform […]

Learn MoreLife in Thornton, Aurora, and Highlands Ranch is bustling, and your orthodontic journey with braces or aligners from Colorado Ortho shouldn't slow you down. Whether you're a student, a professional, or an adventurer, these practical solutions will help you triumph over the challenges of maintaining your orthodontic treatment while on the move. Prepare for […]

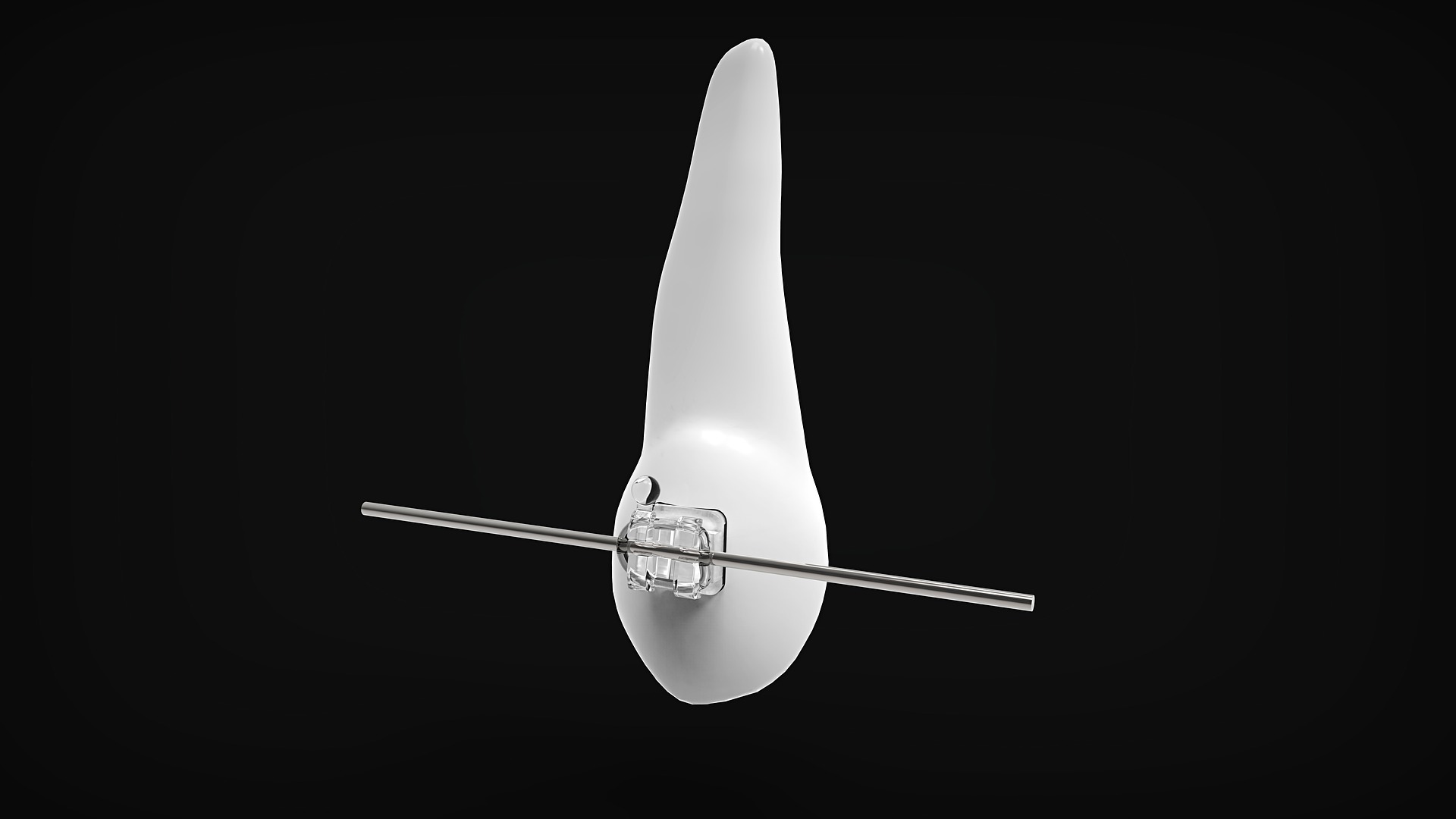

Learn MoreAt Colorado Orthodontics, we believe that everyone deserves a smile they can be proud of. For those seeking a more discreet and aesthetically pleasing option for orthodontic treatment, ceramic braces offer an excellent solution. In this blog post, we will dive into the world of ceramic braces, exploring what they are, how they work, and […]

Learn MoreHaving straight teeth is not just about aesthetics; it plays a significant role in your overall oral health. At Colorado Orthodontics, we believe in the power of a straight smile to prevent future dental issues. In this blog post, we will explore the importance of straight teeth, the potential problems that can arise from misalignment, […]

Learn MoreDid you know that flossing is not only essential for maintaining optimal oral health but also comes with some fascinating facts? In this blog post, Colorado Ortho will share some fun and interesting facts about flossing that will make you appreciate this simple yet powerful oral care habit even more. Flossing and Fresh Breath […]

Learn MoreAs orthodontists, we're always on the lookout for interesting facts and trivia about the field of orthodontics. In this blog post, Colorado Orthodontics in Denver is excited to share an ortho fun fact with our readers - the origin of braces. Braces Have Been Around for Thousands of Years You might be surprised to […]

Learn MoreA beautiful smile can have a powerful impact on a person's life, affecting their self-esteem, confidence and overall well-being. As orthodontists, we understand the transformative power of a beautiful smile and are dedicated to helping our patients achieve the smiles of their dreams. In this blog post, we'll explore the impact of a beautiful smile […]

Learn MoreValentine’s Day is a special time of year to show love and appreciation to those we care about. This year, why not give the gift of sleep apnea treatment from Colorado Orthodontics in Denver? Sleep apnea can cause serious health issues and Colorado Orthodontics is dedicated to providing top-notch treatment for their patients. Here are […]

Learn MoreAs a parent, it can be overwhelming to navigate the process of orthodontic treatment for your child. Here is a guide to help you understand the process and ensure that your child receives the best possible care: Schedule a consultation: The first step in the process is to schedule a consultation with an orthodontist. During […]

Learn MoreDecember is here and our team at Colorado Orthodontics would like to be the first to wish all our friends and family a happy holiday season! Here at Colorado Orthodontics, we proudly offer the highest level of orthodontic treatment in Colorado: providing a variety of treatment options to patients of all ages in Thornton, Aurora, […]

Learn MoreEvery year, millions of people suffer from TMJ Disorder. There are a lot of reasons in which it can occur, and women are twice as likely to experience it than men. For this month’s blog, we will go over TMJ Disorder and what can be done to treat it. Colorado Orthodontics in Aurora acknowledges TMJ […]

Learn MoreSolving sleep apnea on a global scale could result in significant cost savings across the entire healthcare spectrum. It has the potential to reduce the effects of common chronic health concerns and change the lives of millions of people of all ages who suffer from compromised airway, sleep, and breathing issues. The Breathing Wellness movement […]

Learn MoreSince braces last months to years, getting them off is certainly a reason to celebrate. This momentous appointment with an Aurora orthodontist might be just around the corner for you, so it’s important to be prepared for your visit. Read on to discover what to expect on the day you get your braces off and what […]

Learn MoreIn countries around the world, braces are considered a completely standard process. Braces can be an option for people of all ages, and there are different factors that drive us to get braces—some medical and some cosmetic. Let’s discuss some of the more common reasons why people need or want braces.

Learn MoreIf you’re looking to take you or your child’s dental health more seriously, braces could be the answer. Read on to discover more about braces, what age braces are necessary, and when to contact your orthodontist in for help.

Learn MoreThe majority of us are not born with flawless smiles, but we do have the tools and tricks to make those smiles possible. Whether you get braces to correct your bite, straighten your teeth, or increase your comfort, you will find that they can provide a truly unique experience. While most people are well-acquainted with […]

Learn MoreWhatever your reason might be, patients needing to transfer orthodontic treatment while in the middle of a braces treatment are becoming more common. Many families move due to jobs, the economy, or needing new scenery. There are over five million people wearing braces at any given time, which means that nothing has plans to change, […]

Learn MoreIf you have decided that you or your child needs braces then you may have a lot of questions. Whether it is you or your child in the chair, there options and we are here to help you feel mentally prepared to take this step. We will help you to learn all you need to […]

Learn MoreWhen seeking out an orthodontist in , it’s important to understand the initial consultation process and cost. Most initial consultations come at little to no cost to you. However, there are a variety of factors that determine this cost. Read on to discover more about your first orthodontic consultation and how much you’ll pay up front.

Learn MoreMost people have probably been to a dentist at one time or another in their lives. Hopefully, this has been on a regular basis. This might include professional cleanings, X-rays to maintain good dental health, and other routine items. Dentistry is a broad term that is mentioned in regards to the health of the teeth, […]

Learn MoreThe average cost of braces may shock you and your bank account. It’s not a cheap procedure. While there’s no flat rate, braces typically fall somewhere between $4,000 and $6,000 with some going beyond that range. The reason is each situation is unique and different oral situations are going to me more or less work […]

Learn MoreThere’s much more to orthodontics than teenagers with metal braces. In fact, many adults benefit from orthodontic services, too. These services can range from clear aligners and retainers to different types of braces. Whatever your age or need, orthodontics can help you achieve better oral health and a beautiful smile. Discover more about the common […]

Learn MoreMany people look to Invisalign to help straighten misaligned teeth and improve their oral health. Since Invisalign is made from clear, BPA-free plastic, they are a more subtle alternative to traditional metal braces. With Invisalign options, you’ll be on your way to a healthier smile. Learn more about the Invisalign process and where to go for your […]

Learn MoreOriginally marketed as an adult braces option, aligners have recently appealed to a younger audience. Invisalign is a popular choice for many teens since it subtly helps correct teeth alignment without the awkwardness of metal braces. Invisalign manufacturers even reported double the increase of sales from 2013 to 2017, indicating that aligners are becoming the […]

Learn MoreBraces are a big step in any teen’s life. If your child is about to start Teen Orthodontics treatment, they might be nervous or have a few questions. Both you and your child must get your questions answered so you can prepare for your teen’s braces.

Learn MoreInvisalign braces are a great teeth-straightening option that utilizes clear aligners instead of brackets and wires. These aligners are completely customizable to your teeth and can be removed during sleep or when eating. Since they're practically invisible, Invisalign aligners are a great solution for teens and adults alike when it comes to oral health. However, Invisalign aligners […]

Learn MoreOrthodontic treatment can help individuals of any age. But in order to prevent oral health problems later in life, it's best to seek out an orthodontist at an early age. Get to know the recommended age range for an early examination as well as signs that someone may need further orthodontic treatment.

Learn MoreYou know braces. You’re familiar with images of teenagers with metal braces in their mouth as a way to help straighten out teeth. But braces have come a long way and it’s not just the classic metal look anymore. There are ways to have braces that are less noticeable, more comfortable, and more versatile for the wide […]

Learn MoreThe American Board of Orthodontics is nationally recognized as the highest standard of excellence in orthodontics through competency assessments. There are different aspects and levels to how one is deemed board certified. Certification to the board requires multiple boxes to be checked off: completion of a graduate program in orthodontia or Doctor of Dental Surgery or Doctor […]

Learn MorePrivate insurance can be a very complicated issue, especially as it relates to orthodontic care. In this blog, we’ll try to break it down so that you can best know what your insurance may or may not cover and what to ask when choosing your dental plan at your next open enrollment.

Learn MoreWe know that even though we offer arguably the best value for orthodontic treatment in all of metro Denver, orthodontic care can still be very expensive for most families. While you want great care for you and/or your child, and so you likely are not just looking for the cheapest provider (as I often note, if you […]

Learn MoreThis is a question we get nearly every day. Not only from folks here in Colorado but from around the country. The short answer: maybe ….

Learn MoreWe see a lot of folks with CHP and CHP+ in our offices. Many have been bounced back and forth between Medicaid and CHP. With many of these folks, there is some confusion on the subject of CHP and how that works with braces. So let us try to clarify. The answer to the question, […]

Learn MoreColorado Orthodontists serve two locations in the Colorado area. All of our doctors are trained specialists in multiple top programs and fields. Read on to meet the doctors.

Learn MoreThank you for taking the time to visit our blog. Please check back often for weekly updates on fun and exciting events happening at our office, important and interesting information about orthodontics and the dental industry, and the latest news about our practice.

Learn More